Brief

Since my Saturday article, a second sizable bank failed and regulators took extraordinary measures to guarantee both banks depositors over FDIC minimums to try and protect the economy. However, many smaller banks are showing signs of stress and this financial crisis is still ongoing.

This is a short follow up about the ongoing US banking crisis and does not include discussion about Ukraine or Russia.

SVB Bank Follow Up

Over the weekend I listed 3 main risks of contagion from Silicon Valley Bank’s failure: contagion from frozen customer accounts destroying a lot of companies, contagion because other businesses have similar problems, and derivative risk contagion. Good news: there is still no evidence of derivative risk and by announcing a backstop of all depositors, and the contagion risk of many tech firms failing has been greatly reduced (because there is not 120+ billion dollars in capital stuck at a failed bank).

The government is attempting to auction off the remaining bank to a buyer, unfortunately this effort has not yet succeeded. As of this writing, the FDIC is planning another auction tomorrow.

New Bank Failure: Signature Bank

Signature Bank was an entrepreneurial bank organized around small teams that could build their own business ties. Over the weekend they were also taken over. Their portfolio was heavy into Commercial Real Estate Loans in New York City and since 2018 they had also gotten heavily into the Crypto space with banking ties in both lending and deposits. The rumors I hear are that their commercial loan book has gone quite bad recently and might be marked down heavily, but it was the crypto side of the bank that went bad quickly and reporting suggests that this caused them issues on the deposit side as well. Similar to SVB, Signature bank had an outsized amount of high net worth and business banking and a majority of their deposits were uninsured.

New Risk

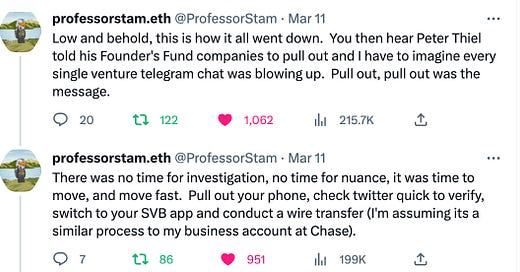

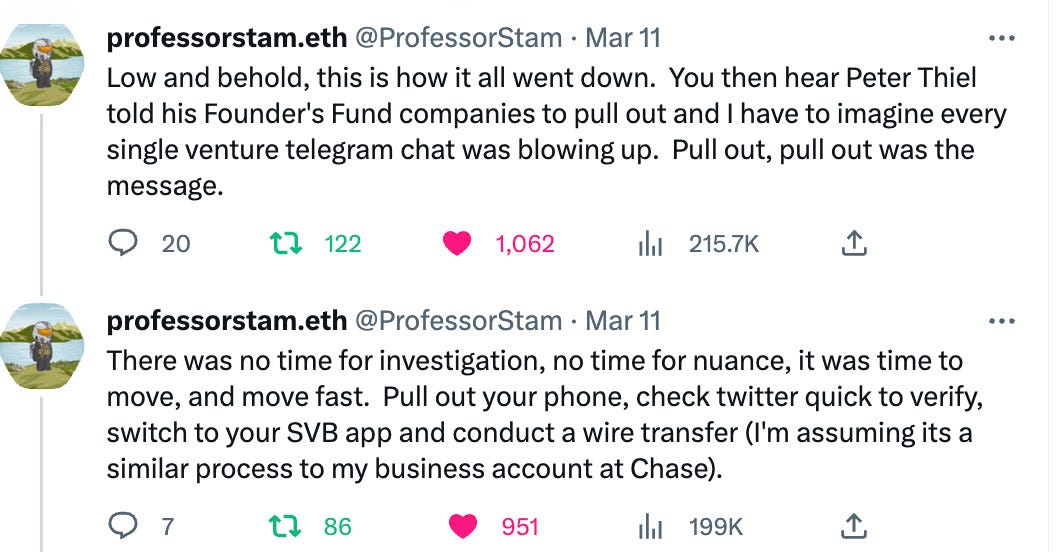

Social Media risk is the name for the risk that in the current era rumors and true information can spread online at rapid speed and people can use apps to pull an impressive amount of money out of a bank very quickly. To the best of my knowledge, this concept was first elucidated by @ProfessorStam on twitter:

This opens the door for well networked people in business, or even well networked viral information to cause a bank run. And once enough people start pulling their deposits from a bank, it can become a self-fulfilling prophecy. There is no banking model that is made to survive 25% of deposits leave the building immediately.

Ongoing Banking Crisis

Unfortunately, the bank crisis is ongoing. Banks with a large number of uninsured deposits are under pressure and it is unclear if they will be facing runs or what their solvency is. This Chart from the Wall Street Journal gives an idea of how bad the situation is (Comerica bank is a key problem among others not on this chart).

These huge price falls show that investors have significant concerns about bank viability and the possibility that all of these banks may not exist in a year. The Federal Reserve has taken the extraordinary measure of saying it will loan out funds in size to support the entire system, but will not be giving details on their loans for a year.

Summary and Analysis

In summary, the FDIC and Federal Reserve are trying to keep the contagion from spreading and the market is still very concerned about the health of banks, especially those with large uninsured deposits. The extraordinary measure to declare Signature and SVB as systemic risks before failure probably did a good job preserving clients and stopping underlying excess economic pain. I am dour on the new federal program because if the news comes out that the fed is loaning large amounts of emergency money to banks without details, I think the lack of transparency could exacerbate the social media risk–opacity and regulatory forbearance often lead to moral hazard and big taxpayer costs. Overall, regulatory actions since the FDIC seized SVB have been solid, but more appears to be needed and the market is pricing a big risk of more bank failures in the US.

Thank you for reading.

Article by @PerceptionMoney, Cohost and finance analyst on @MriyaReport