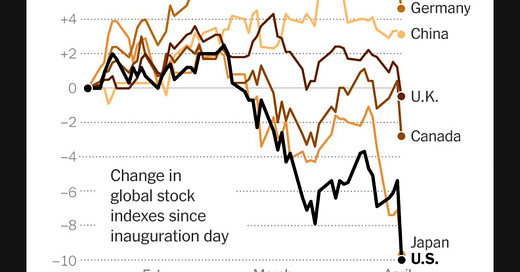

Welcome to getting poorer. As a nation. Announced with the Orwellian title ‘economic liberation,’ the massive increases in tariffs across the board that were driven into place starting April 2 are already creating a global shock to global markets. Stock markets are down heavily since the announcement and since the Trump inauguration, US markets are leading the way downward amongst developed nations.

(Chart from NYT)

The administration's tariffs will push up costs across the board. Businesses and consumers will both feel the pinch, paying more for essential goods and raw materials. Economist Paul Krugman nails the issue plainly: "A tariff is a tax on imports, and taxes make things more expensive, leaving consumers worse off. Protectionism reduces the efficiency of the economy, making the country as a whole poorer." Tariffs don’t just make things pricier—they undermine the efficiency that keeps the economy humming.

It appears the new tariff math didn’t come from economists or trade experts—it appears to come from a ChatGPT prompt. As pointed out by X user @Mickey4x, when you ask ChatGPT, Claude, Gemini or Grok how to “balance trade,” the AI chatbot will suggest matching tariffs to the size of the trade deficit.

That’s the exact logic the administration used–which then published math showing that it is the exact logic that they use. It’s not just simplistic—it’s wrong. This isn’t strategy—it’s economic drunk texting. Slap tariffs, feel tough, wake up with higher prices and fewer allies.

Tariffs don’t build industry—they bleed it. The latest ISM numbers show manufacturing sinking into contraction; massive increases in tariffs will have iinput costs spiking while also making demand drop off a cliff.. That’s what happens when you start taxing the raw materials your own economy runs on. Ask U.S. farmers who are about to stare down soaring fertilizer bills because we slapped tariffs on imported potash (key fertilizer–we get almost all of ours from Canada). This isn’t a new lesson; it's a Smoot-Hawley redux.

(Graph from the Corporate Finance Institute)

Passed in 1930, Smoot-Hawley was the economic equivalent of shooting yourself in the foot, then banning crutches. It jacked up tariffs in a global downturn, triggered retaliatory tariffs (as the Trump tariffs already have), and helped elongate the recession America was in. Smoot Hawley didn’t single handedly cause the great depression, but it made our depression get worse and go longer

Trade runs on trust—and we just torched it. Slapping on tariffs overnight with no strategy and no expert input tells our partners that U.S. policy is a coin flip, not a contract. Even if we walk it back next quarter, the damage is done: future deals will be slower, pricier, and built with one eye on the exit. This isn’t just bad economics—it’s a credibility crisis that puts long-term growth on the chopping block.

—————————————————

Epilogue:

1. We didn’t slap tariffs on Russia at all who we do over 3 billion of trade with still. That’s more than multiple nations we did slap tariffs on. WTF

2. Another sentence from the Corporate Finance Institute article linked above stands out. “The legislation did the most harm by souring trade relations with other countries”

Article by