The Russian economy is mired in a recession worse than the 08 Great Recession. These reports of ‘only’ down -2% or -3% are politicized garbage and should be viewed as more disinfo from the Kremlin.

Rosstat, Statistics Bureaus, and the IMF

We look to statistical agencies to help us understand what is going on in a country. In the US, you can get high quality data from the Federal Reserve, BLS, and other government agencies. The UK has the Office of National Statistics. As a rule of thumb, most wealthy and middle income countries build honest statistics bureaus because it is impossible to create a good economic policy without knowing what's going on.

In stark contrast, Russia’s statistical agency, Rosstat, is heavily politicized and paints the picture leadership wants it to. Back in 2019, Rosstat drew internal fire from Russian economist Kirll Tremasov, who said Rosstat was “drawing instead of statistics” (Tremasov is currently the head of Bank of Russia’s monetary policy committee, aka a pro-Russian apparatchik). When Russia launched the full scale invasion of Ukraine in its Feb 2022 ‘Special Military Operation,’ the Russian government felt that Rosstat was not politicized enough. The head of Rosstat was replaced with even more Kremlin friendly Sergei Galkin. To make sure that the statistics of the Russian economic disaster were hidden, the Kremlin kept going and had the central bank suspend requirements to publish information required by Russian accounting standards, and Russian companies no longer need to report full information on beneficial owners and key executives.

Rosstat should be viewed as a lying liar who lies. In December 2022, Rosstat pushed back reporting for the year end GDP number with an ‘estimate’ of a 2.5% loss. Apparently that was too negative for the Kremlin, so the final number came in late February at -2.1%.

Let’s ask the real question:

What Happened to the Russian Economy in 2022?

What really happened to the Russian economy in 2022? It fell off a cliff. Let’s start with a few reference points of their economy: auto sales, housing sales and petrol product production (for a brief moment, we will skip the literal health of over 400,000 dead and wounded Russians from the war).

Automotive Sales: were down a total 63.1% from Jan 2022 to Jan 2023. With many foreign brands leaving – only the two Chinese brands, Haval and Geely, greatly increased their Russian auto sales by stepping into the hole left by foreign firms and amid struggles with Russian industrial concerns, such as embargoes on foreign industrial semiconductors.

Housing Sales: Getting housing data on Russia is difficult given that the government stopped publishing official numbers on all sorts of key data. Price and mortgage rate data is easy, but sales volumes numbers are hard to come by – the Russian government is attempting to hide how bad the situation is becoming in Russia. However, some numbers are being reported and by the best estimates, sales in Russia are down about 22% with Moscow down 30%. Housing supply is also up over 30% on the market since 2021, before the full scale invasion.

Petrol Production. Cutting off Europe from Russian natural gas caused a power shortage and a huge natural gas price rise in Summer 2022. However, Russia now is making 20% of its former natural gas revenues and that number is declining. Unlike oil, natural gas requires heavy infrastructure investment to deliver and that revenue has disappeared for the near future. With the explosion at the shut down Nordstream pipelines, repair work would need to be undertaken for gas deliveries to resume.

Oil production is holding steady at about 7 million barrels per day but the oil price cap has caused the Russian oil price to crater and even the non-sanctioning countries such as India and China are getting big discounts on Russian oil, again. While Russia is able to recoup some of this revenue, much is now going to foreign partners and buyers, cutting into their overall revenue.

Taken in total we have a country whose auto sales volumes are down 63%, housing sales volumes down at least 22%, and domestic auto production is faring poorly due to lack of industrial chips and parts. Petrol is the biggest sector of the Russian economy and is now losing both revenues and volume (especially due to the loss of natural gas sales to Europe). Further 150,000 military aged men have been eliminated with an estimated 2-5X more injured. This is not the picture of a country down 2%. This is the picture of a country that is experiencing something worse than the US great recession. As a reference point, in the US Great Recession of 07-09, auto sales dropped 40% and housing sales dropped about 33%.

How is it that the IMF is estimating -2.2% GDP for Russia in 2022? By believing Rosstat. The numbers we have in Russia that are not from Rosstat cookbook show a bleak picture of an economy in a deep recession.

Industrial Production in Russia

Russia is a country where the messenger gets shot and managerial styles are about top-down control. Into that context, what happens when Russia can’t get enough spare parts in, many high skilled workers leave your country (foreign and domestic), and they’re under sanctions destroying their normal supply chains?

Fire. Lots of Fire. Some examples: we’ve got fire at the Moscow based Roscomos weapons plant

And fire at the Monchegorsk Nickel Factory:

Russian industrial fires were estimated at 330 in 2022 for Russia (these numbers are not easy to confirm and it is not clear how to classify some fires. In short, it's a lot). Some of these are likely Ukrainian sabotage, but many are systemic breakdown of equipment. In many factories, all it takes is a pipe or a machine part to go past its expiration date to result in a catastrophic cascading failure.

Economically speaking, these huge fires are a disaster. It is not consistent with merely 2% down reported by Rosstat for the 2022 year. Quite literally, the Russian economy is burning down.

Currency Strength (is not economic strength)

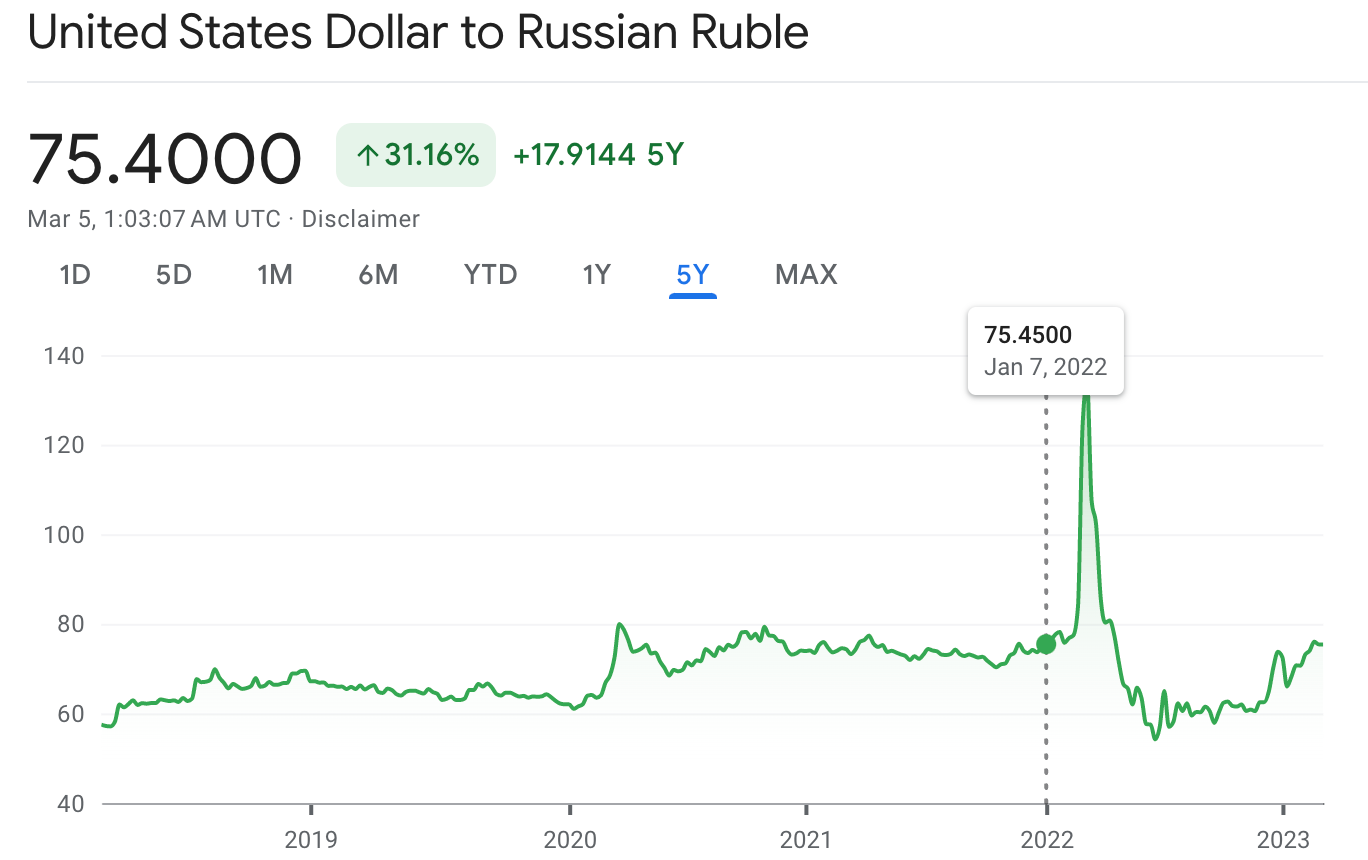

Two things regularly get conflated with economic strength: currency rates and stock markets. The correlation is sometimes completely off. Currency markets respond to balance of trade (imports vs exports), government budgets, and country legal policy. In the case of Russia, their currency had a wild ride since the start of the war and is basically back to where it started.

After an initial spike at the start of the war, the Ruble strengthened to stronger than it had been in years precisely because import sanctions prevented a broad range of critical machines and components from reaching the Russian economy at the same time as Russia continued large exports of Petrol products. However, as the war continued forward, the Russian economy deteriorated and the Russian budget moved from surplus to deficit. The currency is again weakening. While the currency is back to where it was before the war started, the economy is MASSIVELY worse given the huge loss of Russians to the war and emigration, paired with the significant disruption from sanctions and destruction in the private sector.

In short, the currency rate is not indicative of economic growth, it’s not indicative of industrial production or standard of living. Many factors go into it and the currency rate is not telling us that the Russian economy is all good. The Russian economy is roundly screwed and it is getting worse.

Russian Future

Where does Russia go from here? With high conviction, I expect the Russian economy to continue shrinking in 2023. Effects of sanctions work with a delay and will continue to cause problems over time. The Russian population is shrinking and the expats are unlikely to return. Their industrial base is shrinking and they are unable to build the machines that go into factories and Russia now has difficulty importing the machines for factories because of sanctions.

Don’t make the same mistake as the IMF. Don’t believe the Rosstat hype. The Russian economy is going from bad to worse.

Article by @PerceptionMoney originally published on Mar 8, 2023