Buckle Up Buttercup. Banking Crisis Continued

First Republic Dies and Finance Firms Keep Tanking

Brief

First Republic failed Friday, April 28. After JP Morgan purchased the bank with Fed support, Chief Exec Jamie Dimon, declared, “this part of the crisis is over.” Yet, he already appears dead wrong.

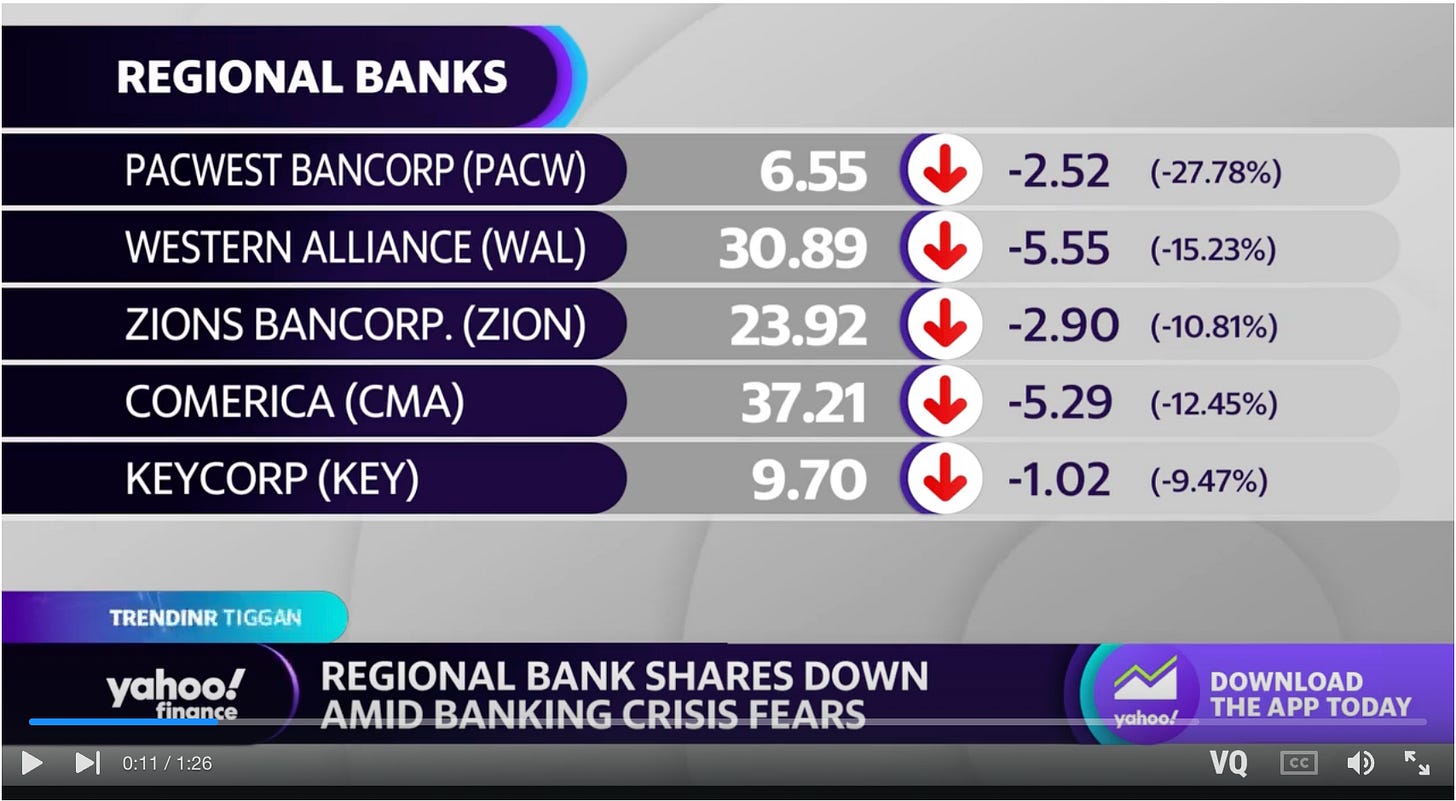

First Republic was taken over by the FDIC and JP Morgan still required massive guarantees against losses to seal the purchase. The market responded to this failure in the two days since then by hammering Regional and other financial firms; PacWest led the way down today (May 2) with a 27% loss. When in doubt, I prefer Mr. Market to any talking head, and Mr. Market says we are in deep trouble.

First Republic Failure

First Republic failing was not a shock. First Republic had been on death’s door since March when a ton of deposits left the building. It needed $100 billion (!) of federal financing to stay alive. It also required a broad capital injection from a consortium of Wall Street Banks.

When a bank stock loses over 70% of its value in a month or less, its future is bleak. First Republic’s focus on deposit growth and wealthy clients left it with a high percentage of uninsured deposits (the FDIC insures accounts up to $250,000 – accounts with more than that are not guaranteed to get all of their money back if a bank fails). While First Republic did fine loaning to rich clients, the bank still had far more deposits from their clients than loans to them, and also had to purchase large amounts of bonds (like in SVB, just not quite as large in quantity). These bond purchases were of the ‘safe’ variety: medium term government and Fannie Mae bonds–however in a rising rate environment these bonds lose money and are not so safe at all. As panic started to grip mid tier banks, First Republic’s business model, including the publicly known contours of its loan book, got brought into question.

Once a bank’s existence is brought into question by a bunch of key stakeholders, very bad things follow. Like bankruptcy.

First Republic’s problems are not new. Much like SVB Bank, First Republic’s fatal flaw was a rising rate environment and it had probably joined the walking dead months before its demise.1

First Republic Deposits

Good banking requires success on two fronts: deposits (people loaning you their money and keeping it there) and loans. Like SVB and Signature, First Republic had a ton of very wealthy clients and thus a huge amount of uninsured deposits. So when bank depositors quickly panicked, over a hundred billion of deposits left the bank. In the era of the smartphone, money can fly out of a bank quickly by application, from the comfort of an office, kitchen table, or coffee shop. And when over half a bank’s deposits fly out the window, Humpty Dumpty falls off the ledge–First Republic had over $176 billion in deposits at the end of 2022, and required more than 100 billion in life support deposits within 4 months. Yikes.

There are a few ways a bank can mitigate this massive capital flight. Deposit runs are difficult to solve for traditional individual banks. In the course of banking history, banks are always susceptible to the possibility of a self-reinforcing cycle of clients leaving. It is even immortalized in the children's film Mary Poppins.

First Republic Loans

Good news! First Republic had great loan quality! Benefit of catering to rich clients: they almost always pay you back.

Bad news! First Republic had a ton of loans made during a lower rate environment. Making a lot of loans to great borrowers is a recipe for a lot of low yielding loans that will always pay back. As a business model, this is fine, unless rates rise fast.

In technical terms, First Republic took lots of interest rate risk and no credit risk. Banks that are less susceptible to rising rate environments run business lines with credit risk. High credit risk business lines have much higher spreads, trading off the possibility that some loans will default. Some business lines like this: credit cards, merchant cash advance, and subprime automotive lending. An example to explain the point: performing credit card portfolios have loans ranging from 12-20+% while lenders face significant default risk. Banks must keep more capital on hand to deal with the risk of default than the risk of rising rates. First Republic did not, as a notable percentage of their business, have any higher yielding loans with credit risk. Specializing in loans like Mark Zuckerberg’s mortgage at 1.05% is a great way to have no defaults, but it results in no room to make money if rates go up (note i’m aware that loan was made in 2012, but it illustrates the point perfectly all the same, Fed Funds were at 0 as recently as the start of 2022 due to covid recovery).

Altogether Now: A Crash

Once it gets out that a bank may have some problems, depositors, especially uninsured depositors, become likely to pull all their money at once. This can cause a teetering bank to fail on the spot. This happened to First Republic Bank. While $100 billion (!) of temporary deposits from the gov held it together momentarily, their prior loans were made at lower rates to the point where First Republic was likely operating at a loss. Humpty Dumpty could not be put back together again and the bank was seized and sold to JPMorgan on Friday April 28.

Unfortunately, this did not end weakness in the financial sector as the problem of interest rate risk is systemic in nature.

Who else is at risk?

When in doubt, trust Mr. Market. Especially for leveraged finance companies, tanking prices can become self fulfilling prophecies. If the stock price of Dupont Chemical tanks by 50%, it is unlikely to cause a feedback loop where a bunch of its clients leave them – they can still produce and ship useful chemicals to large industrial firms. However, banks turn confidence crises into feedback loops – stock price drops, depositors pull their money, people refuse to do business with them, and their ability to make money disappears overnight. Negative feedback loops in banking can cause catastrophic losses very quickly.

It is not just the regional banks; other financial firms showing strain after First Republic bought out:

- SOFI is structured as a bank, and is down just over 10% today

- BREIT, a Blackstone Real Estate Trust for wealthy investors has restricted withdrawals for 6 months straight, only honoring 29% of withdrawals (this is legal for this kind of investment trust; it is also a very bad sign).

- AGNC a mortgage REIT stock, is down 11% this year and 3.45% today

—graphic from Yahoo Finance, obviously, click for full video

Structural Bank Crisis and the Fed

A Federal Reserve pivot to lower rates would help the banks, and possibly help end this slow rolling bank crisis. Many banks have balance sheet problems as interest rates rose quickly for the first time in decades. Most of the media is focusing on the problem of deposit flight, but people are sleeping on the credit problems occurring in this crisis.

Credit problems on bank balance sheets are real. Commercial real estate loans have major problems as commercial real estate never recovered from covid.

Interest Rate risk is also a structural problem faced by all traditional banks.

That we are in a recession where layoffs are occurring in an environment with much higher rates means that there will not be significant negative reinforcing loops of less credit to make loans and less people who want them and more layoffs affecting the real economy.

However, Jerome Powell and the Fed already raised rates after SVB and Signature went bankrupt. Powell idolizes Volcker and his policies but fears his Fed will not hold strong like Volcker. I think this is incorrect macroeconomics, but I am not a Fed Chair and cannot control the path of interest rates. Instead, I can discuss what happens when rates are held at this level or likely raised 0.25% more and then held for a year or more. Such a policy will lead to continued banking instability as well as increased unemployment as the financial crisis works its way through the rest of the economy. Expect layoffs to continue at major firms, if not intensify and continued massive problems in the startup ecosystem as valuations stay depressed. I’m not a perma bear, but its looking pretty bleak at the moment.

I’d like to stop writing about bank failures. Unfortunately, First Republic doesn’t have the feel of my last article on bank failures this year

Banking Crisis Series:

This is my Fourth Article on Failed Banks. There are systemic problems in this slow moving banking crisis, and while the failed banks were badly managed (esp Signature, CS, and SVB), blaming them alone misses the forest for the trees. I do not expect this crisis to end soon.

Earlier Articles

Article 1: US is in a recession + SVB Failure

Article 2: Signature Bank Failure

Article 3: Credit Suisse Failure

Thank you for reading.

Article by @PerceptionMoney on Twitter

Edited by @j_prettybuds on Twitter

As always, NONE of my articles are a recommendation to buy or sell anything.

Fun aside. Zombie Bank is a technical economic term! It means a bank that has economic value below zero but is allowed to keep operating and paying its bills either because nobody is aware of the problems, yet. The more usual understanding is that it is being kept alive by explicit government support, generally known as regulatory forbearance. Depositors can get their money out, and loan holders keep paying, yet the bank is completely dead!